Perceptions matter. The government of the day will be able to garner more support if people feel their incomes are increasing or their employment prospects have improved. True, non-economic factors matter a lot and, throughout history, the ability to stage circuses has been as important for governments as providing bread. But economic factors play a big role in people’s sense of well-being and the latest Reserve Bank of India (RBI) surveys should be a wake-up call for the central government.

For example, shouldn’t the government be concerned that in the June 2017 RBI survey on consumer confidence, the percentage of respondents who said that their incomes had decreased from a year ago was more than in September 2013, during the depths of the balance-of-payments crisis? Should it not worry them that the percentage of people polled who said their incomes had increased from a year ago was lower than in December 2013 and March 2014, when the disenchantment with the United Progressive Alliance, or UPA government, was at its peak? As Chart 1 shows, the net response, or the percentage of people in the survey who said their incomes had increased compared to a year ago minus the percentage who say their incomes have decreased, is the lowest in many years.

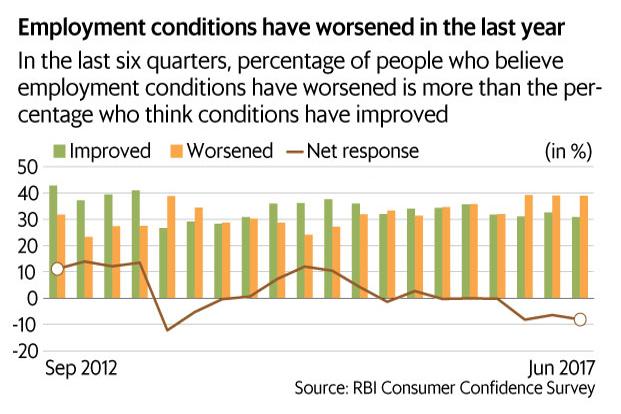

The consumer confidence survey is conducted by RBI in the six cities of Bengaluru, Chennai, Hyderabad, Kolkata, Mumbai and New Delhi. It, therefore, reflects perceptions among the relatively well-off, who have been staunch supporters of the present government. Conditions in less developed areas are likely to be worse. Chart 2 shows the perceptions about employment in the survey. In June 2017, the percentage of households who said their employment conditions had worsened from a year ago was much higher than in March 2014, just before the last general elections. More importantly, the net responses (the percentage of households saying their employment conditions have improved minus the percentage saying conditions have deteriorated) have been negative for six consecutive quarters now. Surely that is a warning sign?

There is, however, one important area where the current government, aided by RBI, has done exceptionally well—it has succeeded in taming the inflation monster. That is why households’ perceptions of overall current economic conditions are still nowhere as bad as they were in 2013 or early 2014. Chart 3 shows the perception of current economic conditions from RBI’s consumer confidence survey. Note, however, that “net responses” have turned negative in the last two quarters, which means that the proportion of those surveyed who thought current economic conditions were worse than a year ago is higher than the proportion who think conditions have improved. It is not a good sign that the percentage of people who think that economic conditions have worsened in the past year is just a bit higher than in March 2014.

Let’s move on to another RBI survey—the industrial outlook survey, which covers the manufacturing sector. Chart 4 gives the employment assessment of the manufacturing sector. Once again, the survey shows the situation is not as bad as it was during the days of the taper tantrum in 2013. But it cannot be a comfort that the percentage of manufacturers who think that employment is increasing in June 2017 is lower than what it was in March 2014.

Perhaps people think their current travails are temporary and things will get better soon? At first glance, that seems likely. In the consumer survey, for example, a net 37.7% of those polled in June 2017 think their incomes will be higher a year ahead. That’s in contrast to the net 1.4% who felt their current incomes were higher than a year ago. But then, people always feel the future is going to be better. For instance, in December 2013, a net 37.2% felt their incomes a year ahead would be higher. That’s not too different from the June 2017 number.

We have a similar situation in regard to employment prospects too. A net 28.4% now think their employment prospects will improve a year ahead. Contrast that with June 2014, in the first flush after the election, when the net percentage was as high as 54.9%. Those early hopes have been dashed.

Every economist has said that for the economy to really start looking up, we need to see a turnaround in investment demand. Is capital formation going to improve soon? Look no further than the latest RBI survey of professional forecasters. The median forecast of gross fixed capital formation (GFCF) for 2018-19 is 29% of gross domestic product (GDP) at current market prices. For comparison, GFCF in 2013-14 at current prices was 31.3% of GDP. Investment demand will get better, but it’s likely to be a slow uphill task.

The current government has done a lot by way of structural reform. A lower fiscal deficit, low increases in minimum support prices, removing petroleum subsidies, the introduction of the goods and services tax (GST), the bankruptcy law and the law regulating the real estate sector are examples. Analysts have pointed out that some of these reforms, while being beneficial in the long run, may have a negative impact on the economy in the short run. That is very likely. It is also possible that the short-term disruptions are resolved by early 2019, before the next elections, and perceptions improve dramatically.

But what if that doesn’t happen? The government should take the results of the RBI surveys as an early warning signal.

Manas Chakravarty looks at trends and issues in the financial markets. Respond to this column at manas.c@livemint.com.

No comments:

Post a Comment